Crypto adoption surges in the UK while sensible regulation firms up

During its announcement on new rules for marketing cryptoassets this month, the Financial Conduct Authority disclosed that estimated crypto ownership more than doubled in the UK between 2021 and 2022.

The survey contained statistics that pointed to a broader surge in adoption of crypto across the country:

- 9% of the adult population said that they owned crypto in 2022, up from 4.4% in 2021. This equates to almost 5 million people.

- 91% of respondents said they had heard of crypto in 2022, up from 42% in 2019.

- 93% of those surveyed purchased crypto with disposable income, long term savings or prior gains.

Prior to this, in May, FINRA, the US Investor Education Foundation, released a research study on investment trends among Gen Z - those aged 18-25.

Specifically, the study examined attitudes and behaviors around investing among young people in the US, UK, and Canada. The numbers for the UK were stark when it came to cryptocurrencies:

- 50% of Gen Z investors owned crypto

- 48% of those polled considered buying property as the main priority of their investment activity.

In the US, the trends are similar. 55% of Gen Z investors primarily invest in crypto. This rises to 57% for millenials. Crypto is also the gateway for nearly half the investment activity among Gen Z investors, more popular that mutual funds or stocks by quite some distance. 25% of Gen Z investors own NFTs in the US too.

That is where the similarities end for the US and the UK.

The US crypto sector is undergoing significant turmoil, driven largely by a ‘regulation by enforcement’ approach from the SEC. Earlier in June, the regulator filed a lawsuit against Binance and Coinbase, two of the world's largest crypto exchanges, for allegedly offering unregistered securities. The SEC is also embroiled in a legal dispute with Ripple over the status of its token, XRP.

Coinbase has been urging US regulators to clarify rules on crypto so they can comply. Over last weekend, Coinbase CEO Brian Armstrong was interviewed at length about the issues facing the sector. If you haven’t seen the interview, then its really worth a watch.

In contrast, the UK’s steady march towards more sensible, predictable, and clearer regulations around crypto mean that it is being increasingly considered as a hub for digital assets. Last week, US VC giant Andreessen Horowitz (a16z) named London as the location of its first international office. A16z will focus on supporting the development of crypto, blockchain technologies and associated web3 startups, having committed $7.6 billion to crypto startups globally already.

Both Rishi Sunak and Kier Starmer were interviewed at London Tech Week last week too. While the focus was primarily on AI, their appearances demonstrate how seriously the UK’s leaders are - hopefully - taking in ensuring the country remains a leader in all things tech, including blockchain and digital assets.

Underlining this, in April the All Party Parliamentary Group for Crypto & Digital Assets published its report setting out its vision to make the UK the global hub for cryptocurrency investment, committing to create the right conditions for cryptocurrency and digital asset businesses to set up and to scale up in the UK. Critically, the report said:

"Cryptocurrency and digital assets have the potential to significantly transform the established financial services system and the way money is dealt with. The rapid growth of cryptocurrency and digital assets in recent years and the increased interest and adoption amongst consumers and investors, suggests that the sector needs to be regulated to protect consumers and to promote investment and economic growth.”

It finished by stating the UK “must move within a finite window of opportunity within the next 12-18 months with the aim of ensuring early leadership within this sector”.

The direction of travel in the UK is more positive than it was 12 months ago. The acceptance that crypto is not just here to say, but is a critical feature of the lives of the younger generations should hopefully encourage efforts to accelerate innovation and adoption in the UK.

Crypto HNWIs: who they are and how they made their wealth

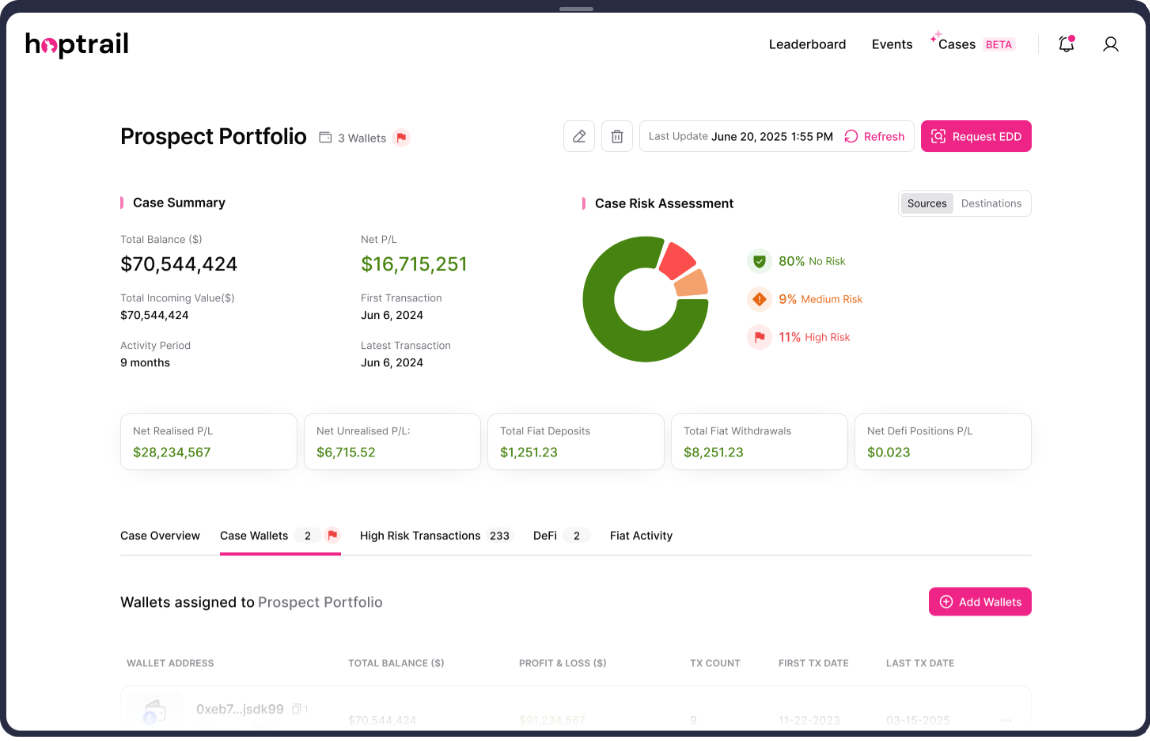

Cases: new source of wealth capabilities and upcoming features

Why we built Cases: A personal note on solving the crypto source of wealth headache

Subscribe to the Hoptrail newsletter

Sign up with your email address to get the latest insights from our crypto experts.