The re-rise of AlphaBay: a decentralised darknet market

Desnake’s return

In August 2021, online user ‘Desnake’ resurrected what was once the world’s largest darknet marketplace, AlphaBay. Originally launched in September 2014, AlphaBay secured its position at the top by early 2015 with over 400,000 users and $800,000 in daily transactions.

The marketplace was shut down in July 2017 following coordinated action between authorities from the UK, Thailand, Canada, France, Lithuania, and the Netherlands. Canadian citizen Alexandre Cazes, known as ‘Alpha02’ and ‘Admin25’, was identified as the creator of AlphaBay and arrested. Cazes suddenly died in Thai custody in March 2018 in an apparent suicide, though this is disputed by Desnake.

Out of the ashes, and nearly four years later, Desnake has now emerged to restore AlphaBay.

A market looking for a leader

Desnake has timed his reappearance well. For the first time in history, the world of darknet marketplaces lacks a dominant leader. This is due in part to recent law enforcement successes, but also to increased exit scams by surviving actors, and most notably the closure of Hydra marketplace in April 2022 by German Authorities.

Hydra’s closure left three actors vying for the top spot: Versus, ASAP, and AlphaBay. Three quickly became two when a user known as “threesixty” provided information to Desnake revealing a security vulnerability in Versus. Desnake published this information on Dread, a darknet marketplace forum, which forced Versus’ closure. Admins affiliated with Versus have made it known that they attribute the market’s closure to AlphaBay.

Both AlphaBay and ASAP marketplace are relatively small compared to prior darknet giants. AlphaBay hosts 30,000 product listings, while ASAP hosts 50,000, though ASAP is known to allow vendors to duplicate listings.

Data indicates that AlphaBay has 1,300 active vendors, while ASAP has 1,000, though both figures are fractional compared to AlphaBay’s former figures of 40,000 vendors and 250,000 listings at the time of its takedown in 2017. Nonetheless, AlphaBay may be on the cusp of filling the vacuum left by Hydra.

Pivot to decentralisation

AlphaBay’s strategic vision is manifesting in technical innovation. This is apparent in its AlphaGuard technology – a system that allows users to withdraw all funds and settle disputes in the case of the seizure of any or all servers. AlphaGuard has been in development for two years with a standalone trial period of one year.

The system is designed to self-launch by exploiting random servers after detecting an anomaly. Admins have 72 hours to disable AlphaGuard or wallet recovery mode is launched before ultimately self-destructing all databases.

AlphaBay has also developed a proactive solution for dispute resolution, another common darknet marketplace problem. The Automatic Dispute Resolver (ADR) System uses a variety of measures such as extended escrow times, full and percentage refunds, and replacement options to streamline dispute resolution without involving a third party.

If ADR fails, only then is the problem escalated to a moderator to review within 24 hours, reducing the need for human oversight. This means fewer humans are needed to maintain the marketplace thereby reducing vulnerabilities for law enforcement to exploit.

The third technical innovation is AlphaBay’s Trust Level (TL) methodology for risk rating users. Without requiring any additional personal data, AlphaBay has developed a TL rating system using network effects where users rate each other as trusted or distrusted.

Reports of poor behaviour impact TL scores if the report is found to be true. In the case of a false report, the TL score of the reporter would be affected.

TL scores are moderated with warning points, where too many leads to account limitation. TL scores are visible to vendors when a buyer places an order and before the buyer’s personal information is revealed to the vendor to maintain a double-blind system through to escrow. Through the TL methodology, AlphaBay is drawing on game theory principles to minimise fraud.

From Bitcoin to Monero

The latest iteration of AlphaBay has also moved away from Bitcoin and the Tor network. It now only accepts Monero, a token with privacy functionality through ring confidential transactions, stealth addresses, as well as additional privacy layers Bulletproofs and Dandelion ++.

Moving to Monero as the currency of choice is part of a wider trend in the darknet world. Of the 61 darknet marketplaces profiled by Hoptrail, over half support (or supported) privacy coins such as Monero, ZCash, Dash, and others.

In response to apparent law enforcement successes in identifying vulnerabilities in Tor network’s anonymity, AlphaBay is transitioning to I2P.

I2P, or Invisible Internet Project, is a peer-to-peer anonymous network where each client in the network is automatically made into a node through which data and traffic are routed.

I2P differs from Tor in that Tor uses a group of volunteer operated relay servers or nodes to allow users to privately access the internet. Desnake communicated serious concerns over the security of Tor’s anonymity and therefore sees I2P as the solution to greater privacy.

Presently, AlphaBay can be accessed through Tor mirrors, though this will change in the future.

Challenges ahead for exchanges

These technical innovations and value for privacy are part of AlphaBay’s grand vision of a decentralised darknet marketplace ecosystem.

AlphaBay’s ambitions are the most far reaching of any darknet marketplace actor and pose new challenges for blockchain analytics and law enforcement.

Typically, human error is the main route to success for law enforcement against darknet actors. But with a decentralised marketplace using encrypted blockchain assets, seizure becomes hugely challenging, not least because there are no individuals or entities on which the market structure relies.

More broadly the co-opting of Monero for use by AlphaBay and its wider presence on the darknet presents bigger AML headaches for exchanges.

Hoptrail data shows 80 active exchanges which allow privacy coin trading, though many have delisted Monero. And while some privacy tokens have changeable privacy settings, there is limited data on how exchanges permit privacy coin trading and if they can or do undertake source of funds checks.

The re-rise of AlphaBay is disrupting the darknet marketplace ecosystem, but the ripples will be felt across the digital asset industry.

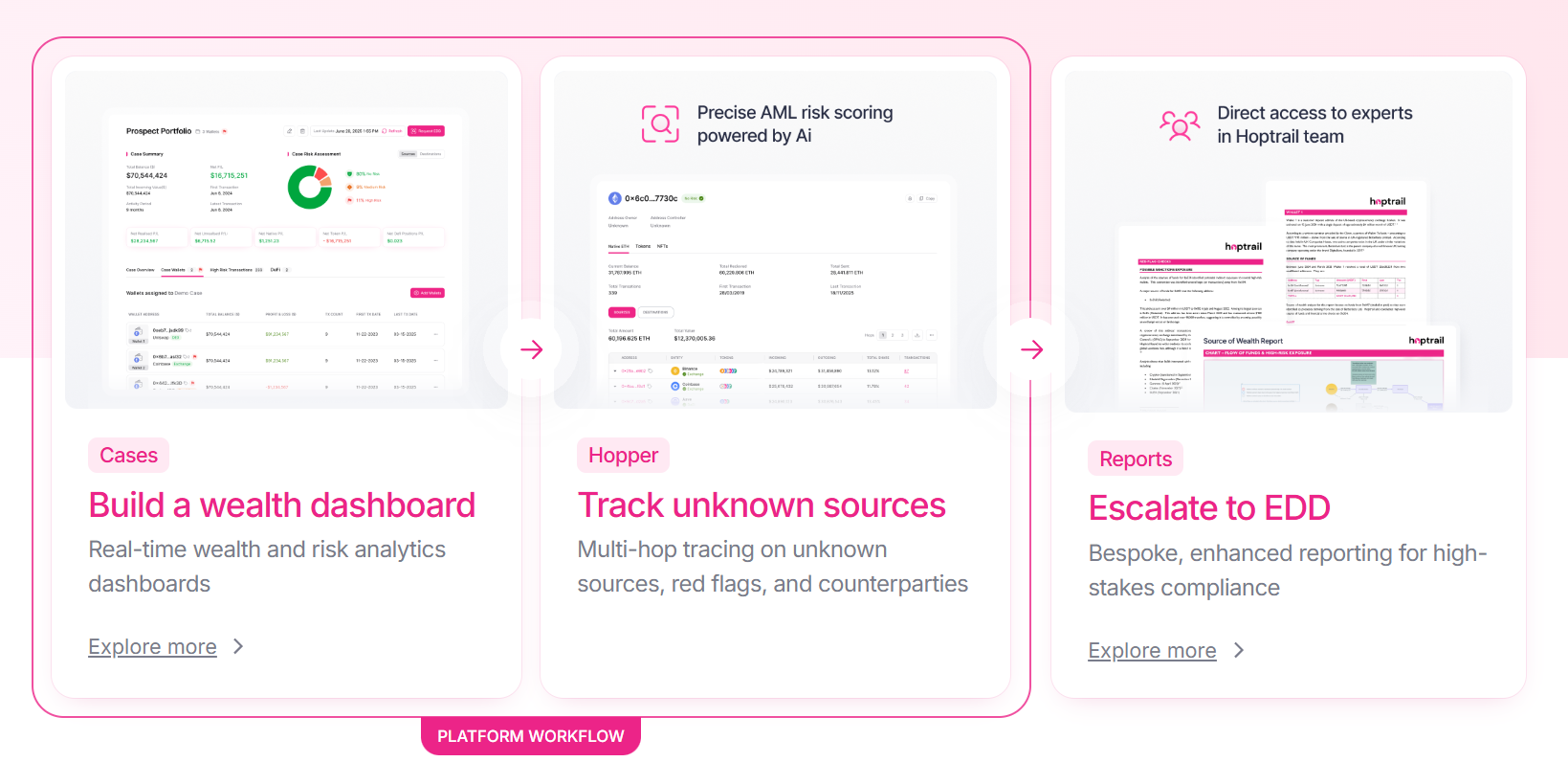

Hoptrail 2.0

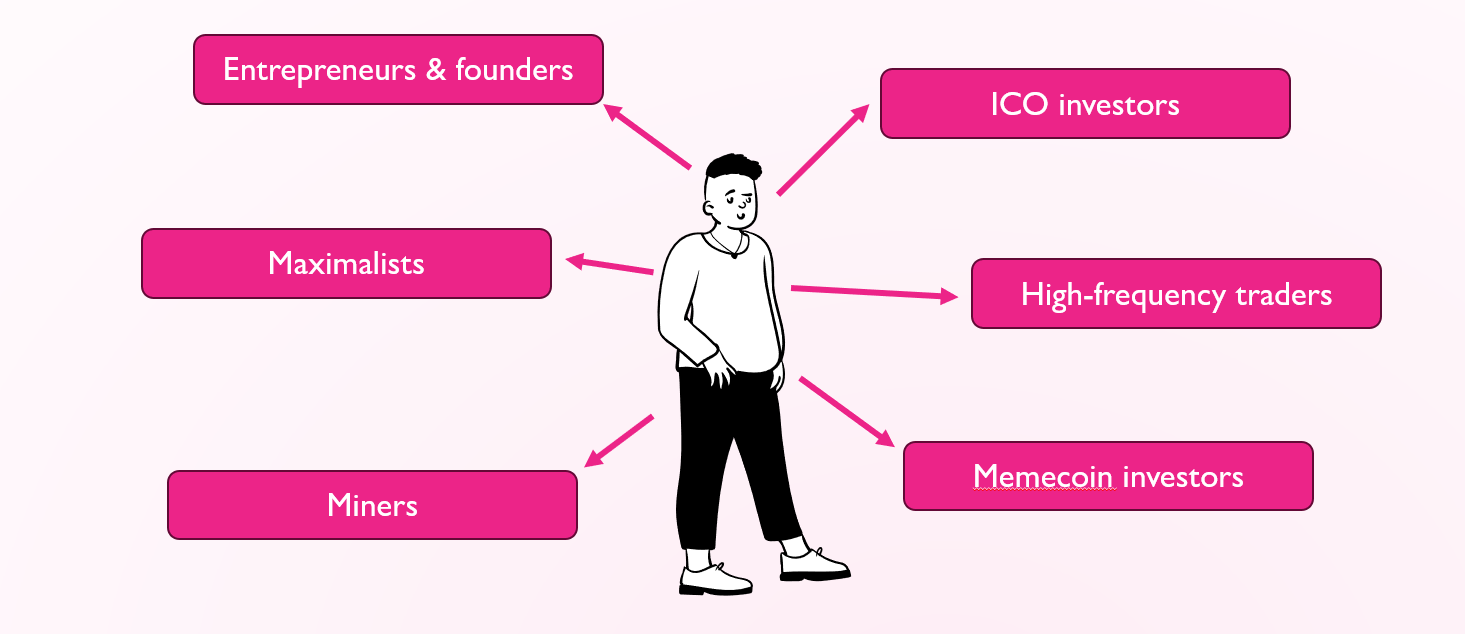

Crypto HNWIs: who they are and how they made their wealth

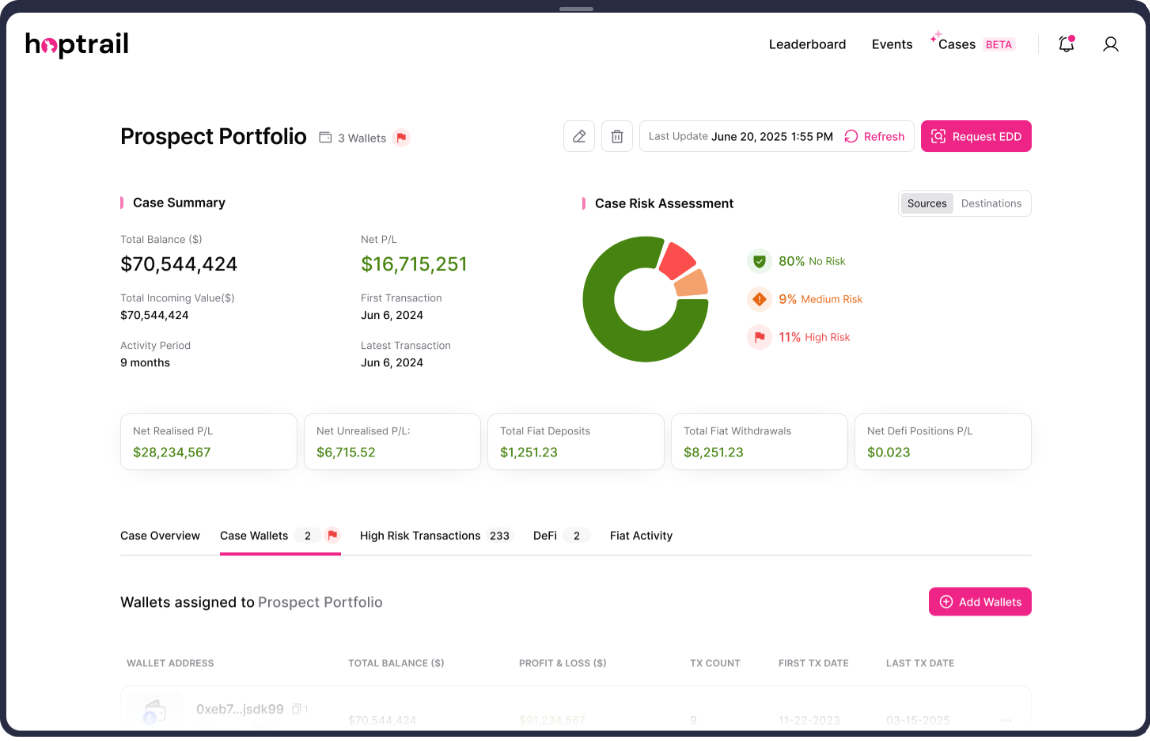

Cases: new source of wealth capabilities and upcoming features

Subscribe to the Hoptrail newsletter

Sign up with your email address to get the latest insights from our crypto experts.